At around €4,550 billion, in 2023, ESG funds accounted for nearly half of the European fund management market

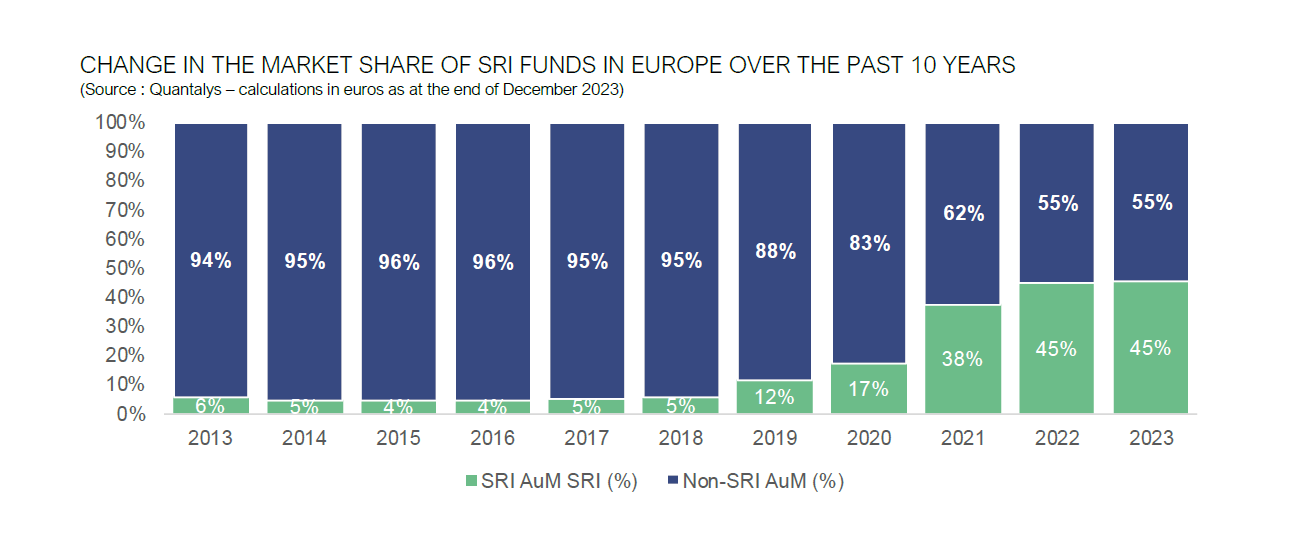

Quantalys Harvest Group, in partnership with Robeco, presents its new edition of the SRI Funds Observatory SRI Funds Observatory. Over the last 5 years, the weight of SRI funds has increased 13-fold and they now account for half of all assets under management in Europe.

2023 marks a turning point for the asset management industry in Europe: almost half of the assets managed by funds and ETFs in Europe are now SRI funds. SRI funds, which until recently had a low profile with €347 billion in assets under management, or 5% of the European market in 2018, have grown 13-fold over 5 years to reach more than €4,550 billion by the end of 2023.

There are several macro-economic reasons for this shift, such as public policies aimed at encouraging the channelling of capital towards Europe’s financing needs, and towards major technological, demographic and climate change (the needs are estimated at an additional €735 billion per year between now and 2030, according to the European Commission’s « Strategic Outlook Report 2023 » of July 2023). There have also been regulatory changes in the financial industry (ESG preferences, SFDR classification, taxonomy, etc.) and investors’ growing awareness of the various health, energy, climate and food crises, which have acted as “accelerators”.

But other trends are at work and are explained in the SRI Funds Observatory produced by Quantalys Harvest Group in partnership with ROBECO:

- an ESG approach that is now integrated into all asset classes: equity funds (42%), bond funds (22%), diversified funds (12%), money market funds, private equity, etc,

- within each asset class, management companies offering a new level of granularity via thematic funds (554 ESG thematic funds) based on Sustainable Development Goals (SDGs), enabling investors to better identify the levers for action: financing the circular economy, water conservation, renewable energies, reducing CO2 emissions, sustainable jobs, etc,

- demand from investors, who are becoming increasingly involved via transition funds (to help traditional companies adapt) and, above all, via impact funds (for companies developing solutions),

- The development of ETFs is also accompanied by ESG ETFs, which already account for 7% of SRI management in Europe, with almost 450 ESG ETFs distributed by the end of 2023,

- easier access for investors thanks to the listing of SRI funds in life insurance policies and PERs: from an average of around one hundred SRI funds per policy in 2021, this number has increased threefold in 3 years to an average of over 300 SRI funds per policy,

- A European asset management industry at the forefront of these issues, funding research and developing independent extra-financial analysis to better direct savings towards European companies that are leaders in their sectors, high performers and committed to the transition,

- There is a need for regulatory harmonisation in Europe to continue to help investors make sense of the jungle of labels and acronyms (SFDR, CSRD, etc.). 66% of French people say that sustainable development issues are important to them, but 72% do not know how to invest responsibly and sustainably (AMF OpinionWay survey – July 2023),

- SRI management has been adopted by part of the asset management industry, private bankers, private asset managers and independent asset managers, since on average 46% of the portfolios managed by Quantalys Harvest Group contain SRI funds,

- a level of performance and risk similar to traditional funds that no longer needs to be proven.

For all these reasons, the Quantalys Harvest Group SRI Observatory, in partnership with ROBECO, anticipates continued growth in this market in the years ahead.

« The Quantalys Harvest Group SRI 2023 Observatory, in partnership with ROBECO, is a landmark event because it marks a massive and rapid shift in the asset management industry towards ESG approaches, which account for almost half of the asset management market in Europe, in order to meet the challenges of tomorrow. Given the importance of these indicators, the entire financial ecosystem is being impacted. This study also shows the enthusiasm of asset managers and the general public for ESG, which is easily accessible via life insurance and PER. Finally, the other lesson to be learned from this study is that investors are no longer content to invest in a generic SRI fund, but want to participate in the financing of certain themes that are easier for them to understand: financing the circular economy, water conservation, renewable energies, reducing CO2 emissions, green bonds, etc. » says Pierre Miramont, Head of Fund Analysis and Model Portfolios at Quantalys Harvest Group.

« We are delighted to be working with Quantalys Harvest Group on this latest edition of the Observatoire de la gestion ISR, and to share this assessment of the state of sustainable finance in Europe. Sustainable finance has undergone a profound metamorphosis in recent years: ESG has become mainstream, a great deal of progress has been made, knowledge continues to grow, and at the same time, regulation is becoming increasingly complex. Having been at the forefront of sustainable investment for decades, and with over 95% of assets under ESG integration, we at Robeco are firmly committed to leading the way in accompanying change towards a fair and sustainable transition. And to nurture investor confidence, a number of factors are essential, including greater transparency and access to quality data to define standards and quantify sustainability. Collaborating with all stakeholders to move towards a more sustainable economy and world is a challenge that concerns us all, » says Karim Carmoun, Chairman of Robeco France.

Press contact: Sophie Grébauval: +33 (0)7 77 83 96 42 | sophie.grebauval@harvest.fr