Digital solutions

We develop standard and customised digital solutions that suit all financial professionals.

Standard SaaS Solution - Quantalys Licence

Quantalys Global Licence is a set of tools dedicated to the analysis and conception of financial proposals for investors. It is aimed at financial advisers, distributors and asset managers.

Get access to huge range of features:

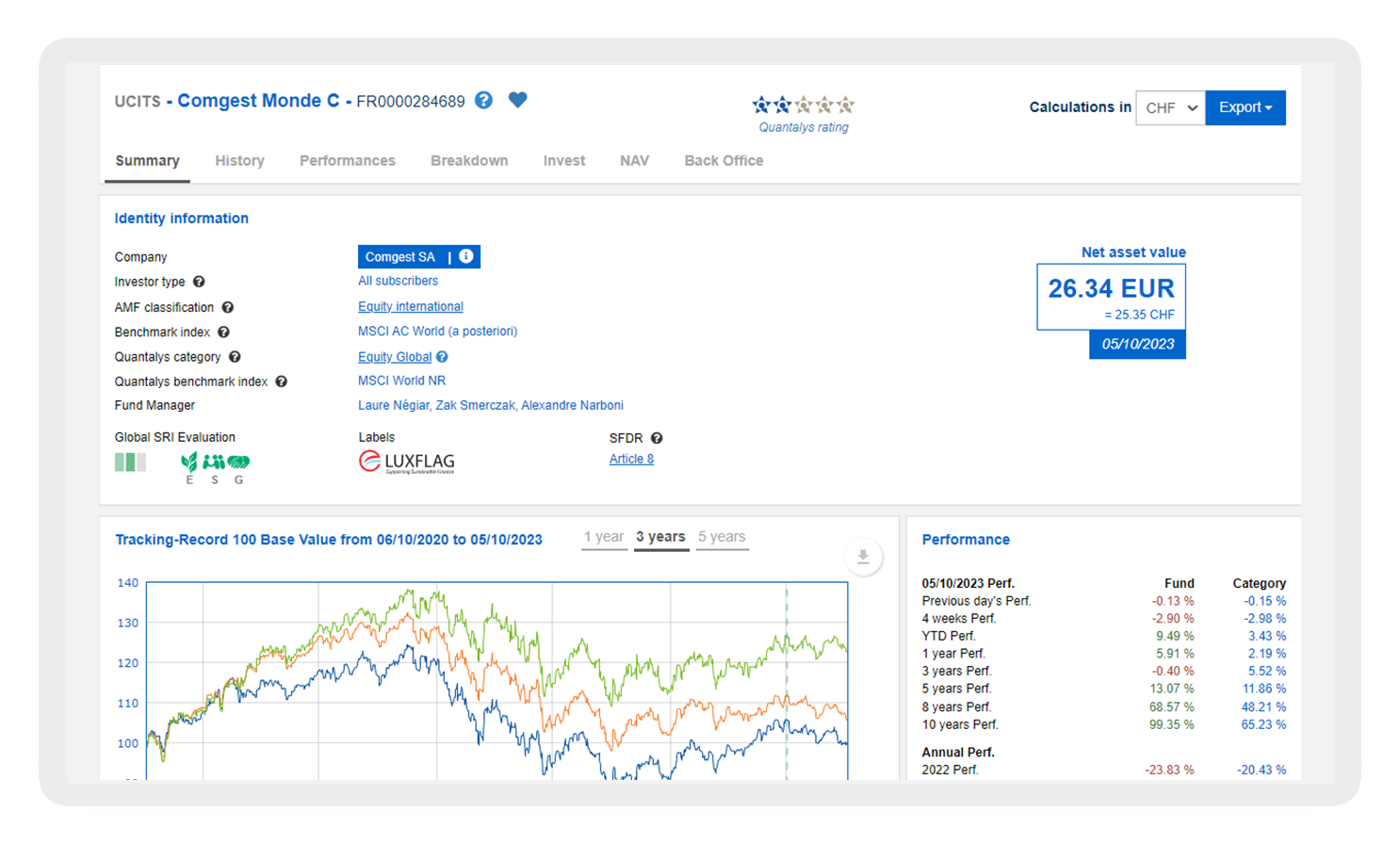

- Multi-country: over 150K financial instruments available for sale in Europe and 800 products (life insurance, accumulation, …)

- Advanced Fund Screener (+ 80 filters and lists generation) and Fund Compare modules,

- Multi-language: regulatory documentation (KIID, Prospectus, Reportings,...) in several languages per country of distribution,

- Multi-currency: 3 currencies of calculation (USD, EUR and CHF),

- Exports data into PDF and Excel format + access to our add-in Excel

- Clear and complete Quantalys Fund Factsheet

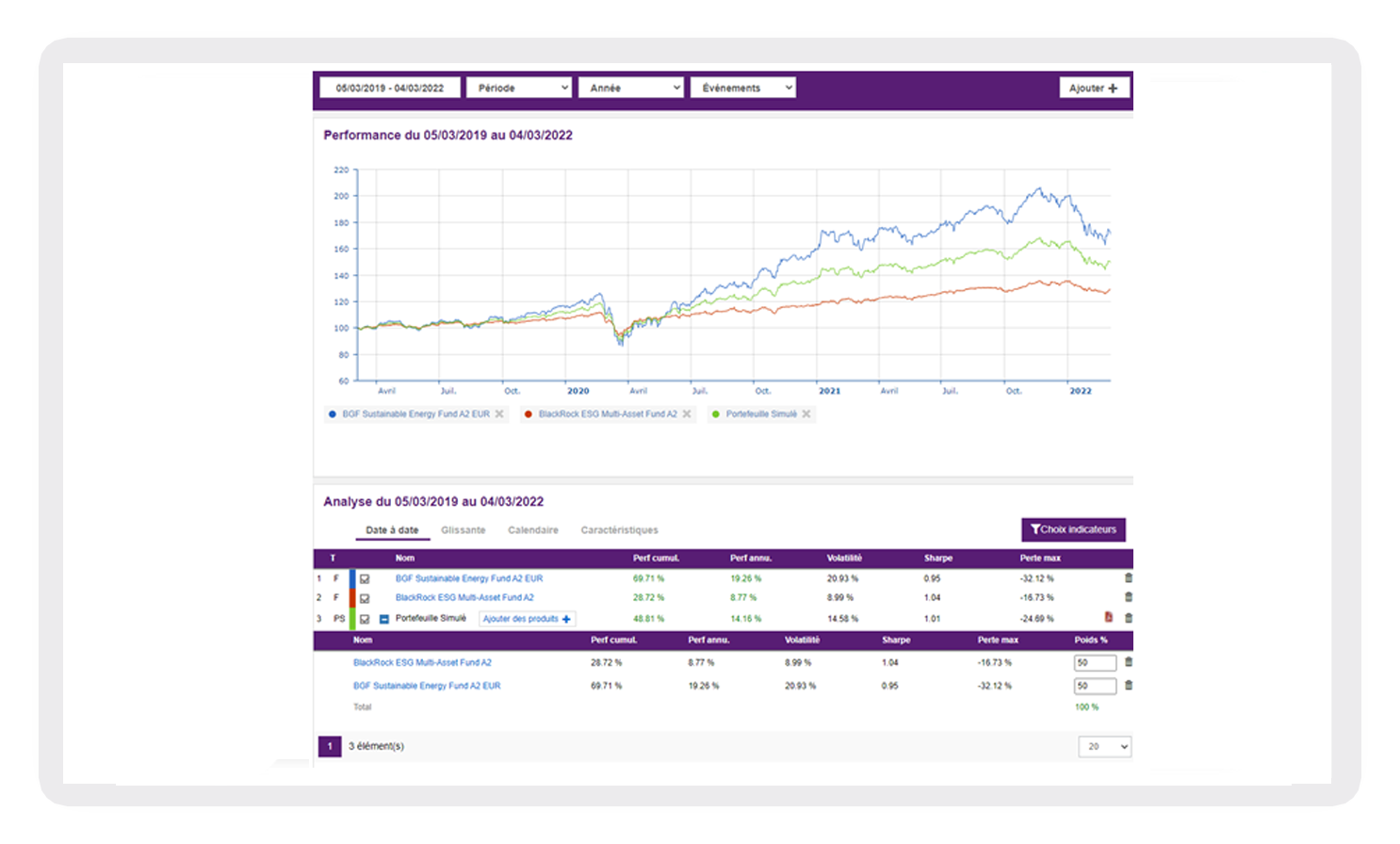

Quantalys Global - Portfolio analysis & Backtesting

Manage your portfolios (clients, simulation, models) and access analysis tools.

Backtest, compare and optimise your portfolios using our robo advisor and proprietary algorithm

Analyse the performance attribution fund by fund, the correlation between the funds in your portfolio, your portfolio's position on the efficient frontier, etc.

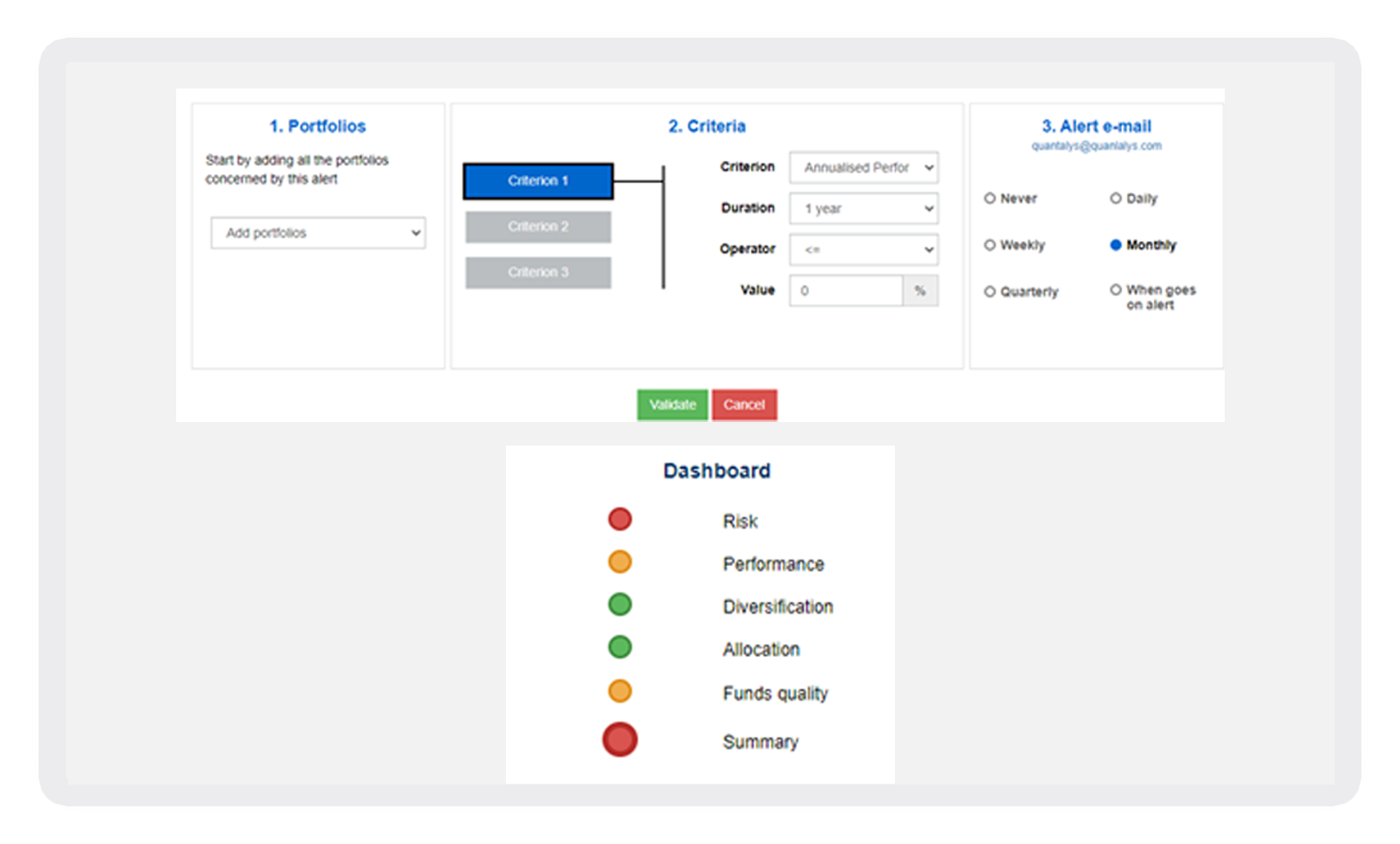

Quantalys Global - Monitoring / alerting module

Quantalys Global allows you to follow the efficiency of a list of fund, portfolio and much more, over time thanks to the alerting and monitoring modules.

Select various quantitative criteria within a alert and select the frequency desired to receive an email when the alert triggered

Everyday, Quantalys tracks and monitors your portfolio on 5 indicators (Risk, Performance, Diversification, Allocation, Funds Quality)

Customised Solution - Quantalys Easypack

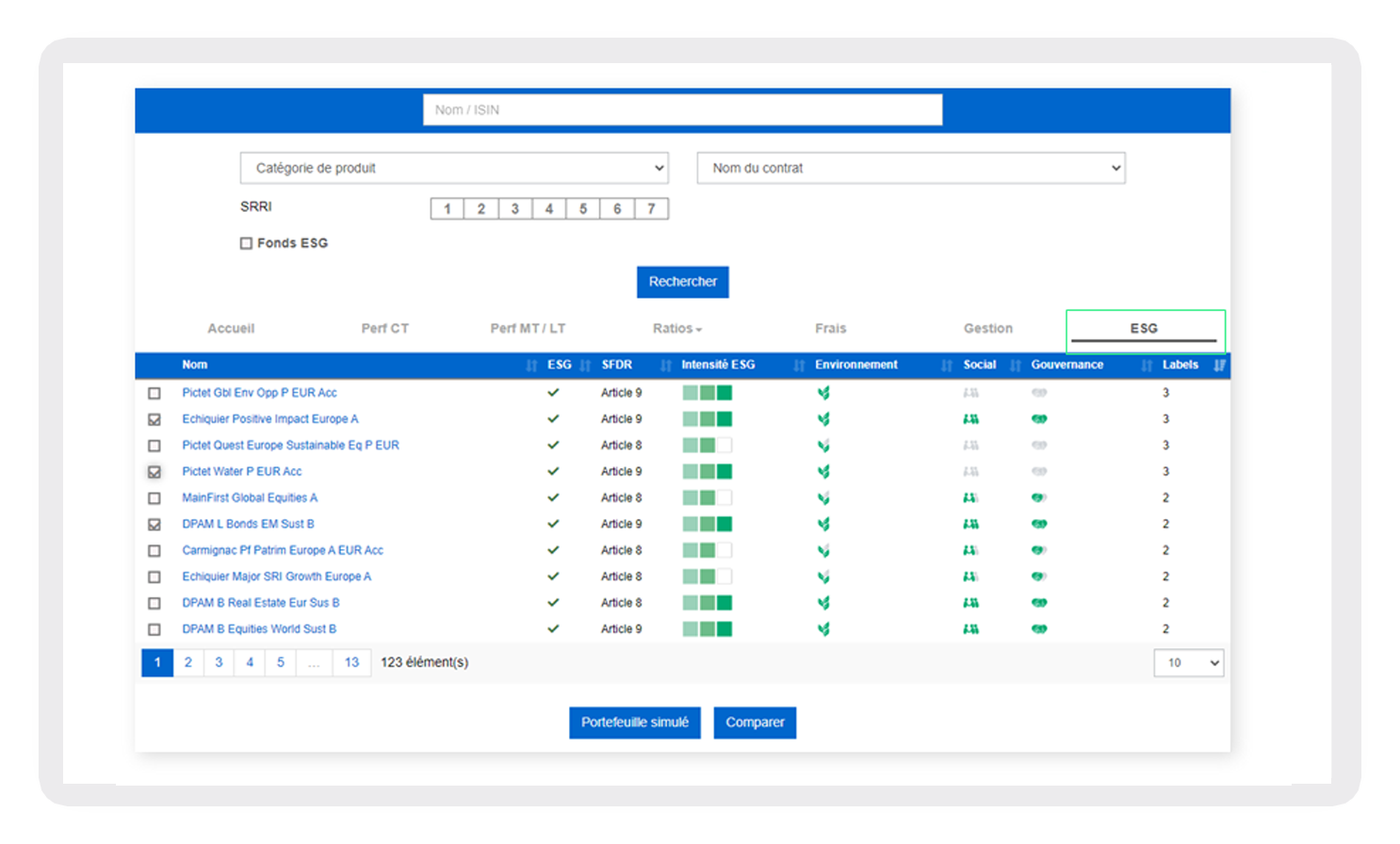

Quantalys Easypack is a standard tool for consulting a range of investment products.

It includes advanced and a la carte Screening Tools (Fund screener, Fund compare, Portfolio simulation / backtesting, ...) that are user-friendly and accessible in a few clicks.

Solution 100 % customisable that can be integrated easily on your Extranet and Intranet.

Quantalys Easypack - Advanced features

This solution can be used to manage different interfaces for different types of users (public, brokers, partners, etc.).

Advanced features such as on-the-fly portfolio simulation or specific support can be displayed only after specific login to the interface.

Quantalys develops solutions dedicated to Managed Portfolio as well.