VIC

Your 100% omnichannel front to middle-office loan sale and approval solution

Our solution

Industrialize your sales process, from client discovery through to loan application approval

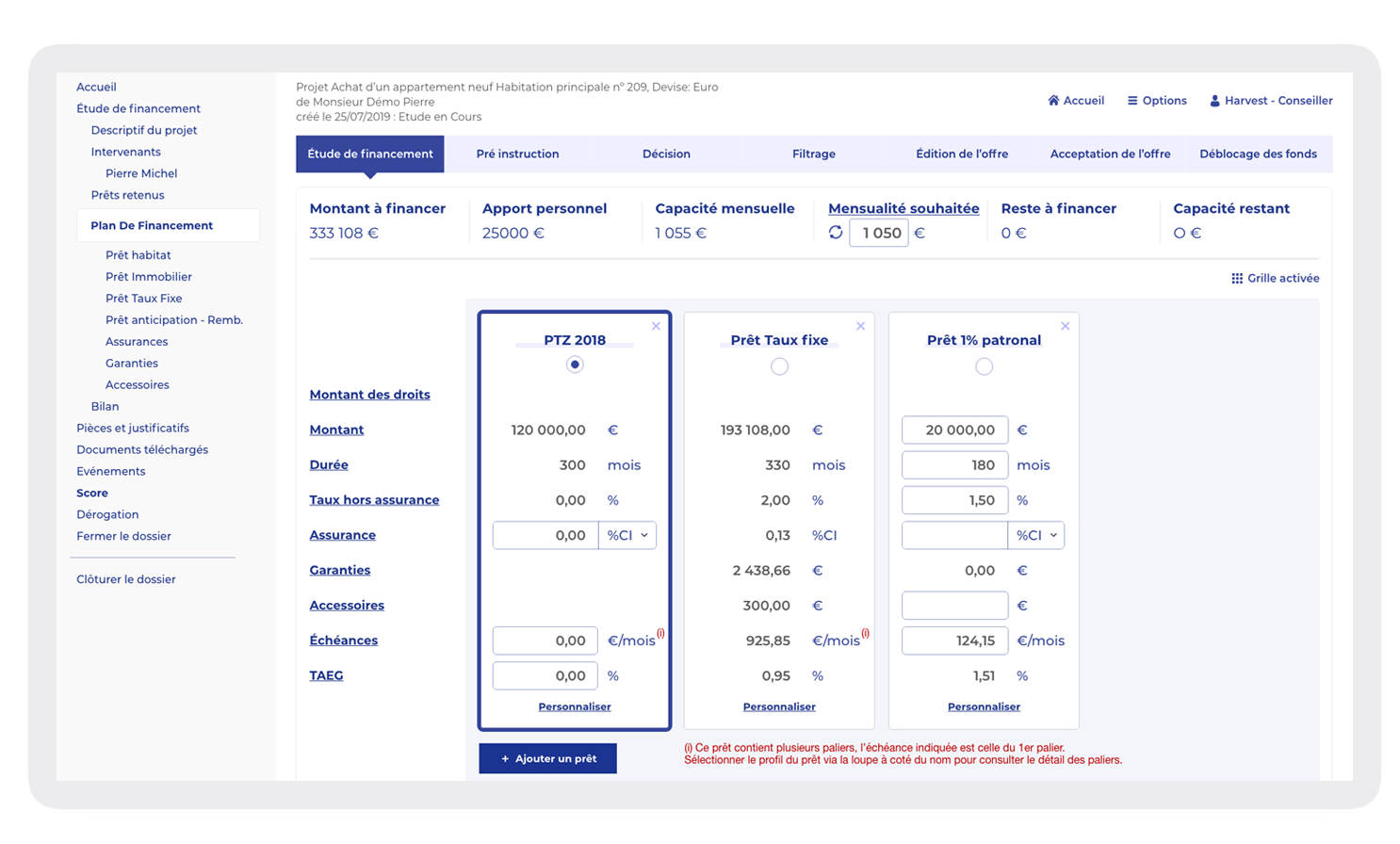

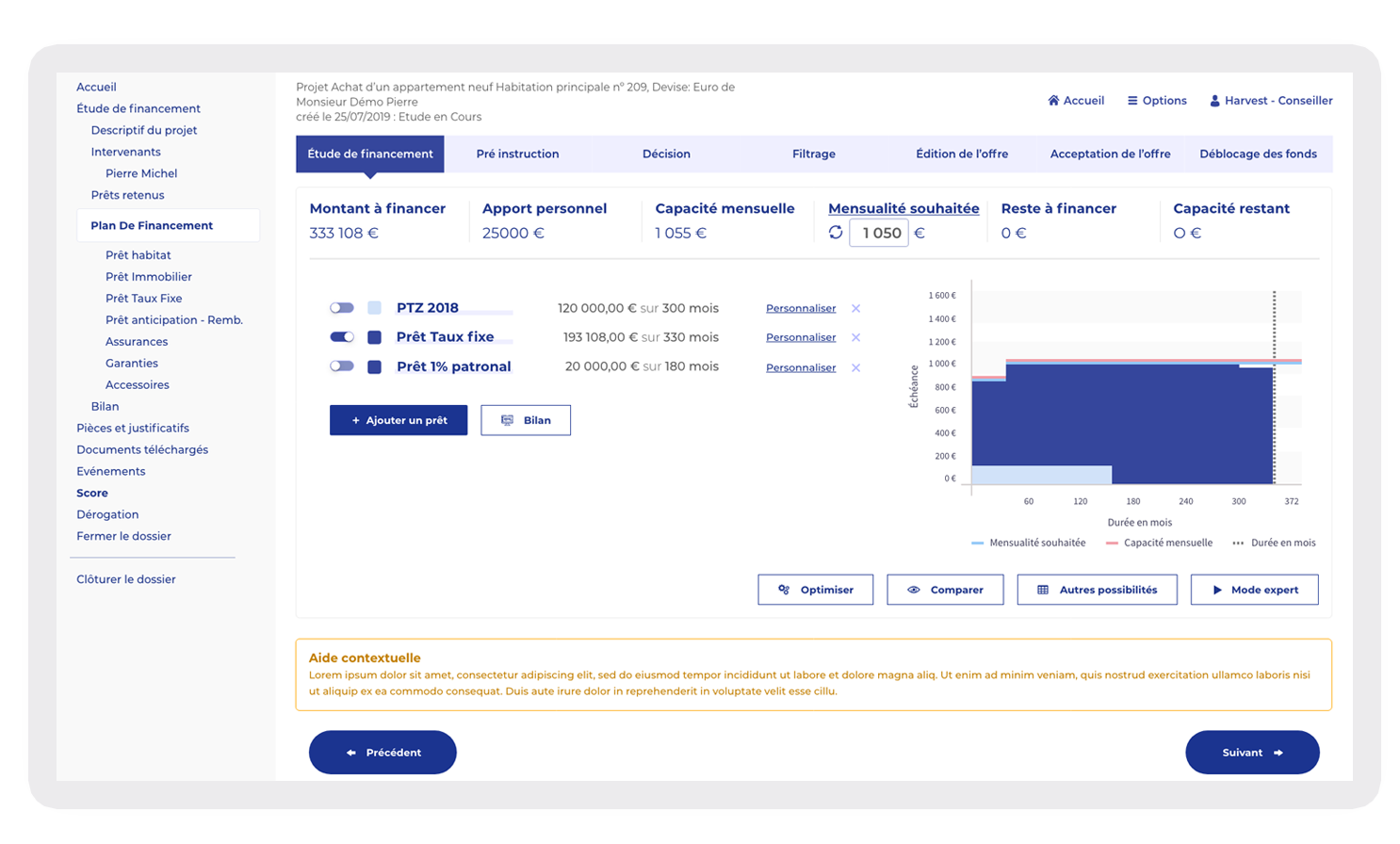

Leverage a powerful finance plan optimization tool

Enable clients to take an active role in decisions about building their loan application

Offer to handle the legal aspects, covering all themes and specifics of the loan

VIC has supported us since the launch of the mortgage loan offer in 2015. Because of our digital DNA, the quality of customer journeys is essential for us. We were looking for a product to educate mortgage lenders, a flexible, easy-to-use tool capable of integrating perfectly into our digital ecosystem. We chose VIC because it was a turnkey solution perfectly suited to launching products under very tight deadlines.

Then, throughout the journey, Harvest's support was effective with a detailed understanding of our needs. VIC's strength has been in adapting to our requirements and evolving with us over time.

Experience has shown that the integration of Harvest into our digital ecosystems has been successful.

Frédéric Niel, Head of retail banking ING Bank France

The benefits of VIC

Easy integration into your ecosystem thanks to VIC services Insurance, score, guarantees, Banque de France, etc.

Independently configure your loan offerings using the Genèse tool

Commercial offering, rates, fees, exemptions, clauses, etc.

Improve your NPS and reduce application processing times

Draw on a cutting-edge team fully proficient in the loans industry and its technicalities

Our VIC Clients